The Automated Clearing House (ACH) System is one of the most important electronic payment systems in the country because of its simplicity, broad reach and economic efficiency. Many churches, nonprofits and ministries are turning to ACH to keep costs down when accepting online donations and event registrations.

So how does ACH work?

The ACH Network allows quick and safe bank-to-bank transactions between parties. Unlike the card networks that process credit and debit cards in real-time, the ACH system is a batch processing, store and forward system. This is important to note as the turn around times from transaction submission to deposit is usually longer for ACH than for payment cards. Lets take a look at an online donation made to your organization with an eCheck and see how The Roles interact with each other during the transaction process.

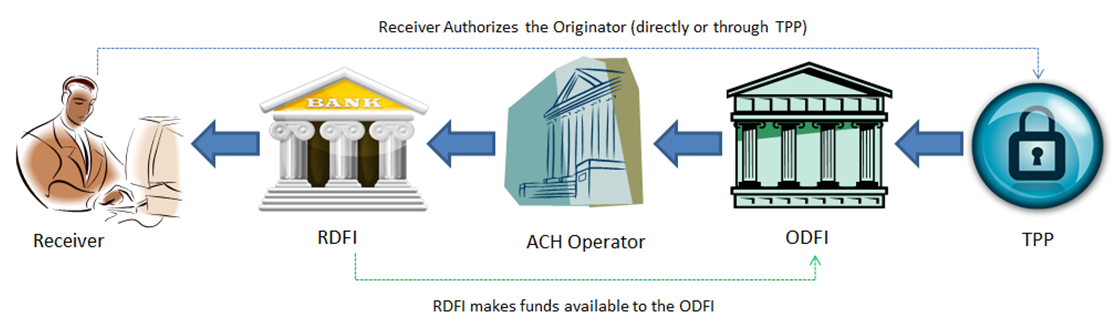

A donor logs onto your website and clicks your “Give Now” button. After filling out the donation form, they select eCheck for payment and enter their bank name, routing number and account number (the same information that is found on a printed check). Now it may sound strange at first, but the donor is called the Receiver, since they will be receiving the debit transaction that collects funds from their account. Your organization is known as the Originator, since you will be originating that debit transaction from the donor’s account.

This transaction is most likely entered using a Third Party Processor (TPP) software solution. The TPP will group the transaction data into a batch with your other eChecks and send them to the Originating Depository Financial Institution (ODFI) used for processing. If you work directly with your bank, you may batch these yourself or this could be an automated process.

The ODFI transmits a file to the ACH Operator where the transactions are distributed out to the appropriate bank, the RDFI (or donor’s bank), and the RDFI will respond with a success or failure. If the Receiver happens to bank with the ODFI, this is known as an “On Us” account, and the transaction is handled without going through the ACH Operator.

If the transaction is successful, the RDFI debits the donor’s account and makes the funds available to the ODFI through the ACH Operator who does the actual transfer of funds. The transaction is then reported on the donor’s account statement. The donor should see the impact of the transaction in 1-2 business days from when they scheduled the transaction.

The ODFI then pays you directly or the TPP (if the Third Party Processor is providing the ACH processing services). In the latter scenario, there is a payout delay as the TPP would group your transaction into a batch for funding, which is processed back through the ACH system as a credit to you, the Originator.

In the case of a failure, the ODFI is notified and given a reason code for the failure. Most failed responses come within the first 3 days, so many Third Party Providers may hold the payout for a few days to give reasonable time for these initial failures to come through before paying out the batch. Failures that come through after a payout are known as Late Returns. If this happens, the transaction is usually netted out of the next batch or collected separately.

For more information on the ACH process, you can check out our full White Paper “ACH Processing: An Overview for Ministries and NonProfits!” or you can visit the NACHA website.