Typically, reconciliation involves working with a convoluted processing statement with daily processing totals and lots of confusing fees. These processing totals have no detail on what transactions are comprised of its total leaving you to add up various transaction amounts for a given day, hoping it will match the total on your statement. This gets exponentially more difficult the more processing sources and products you work with and requires many hours (and strong sleuthing skills) to get your books to balance.

“Detective Hat” No Longer Needed

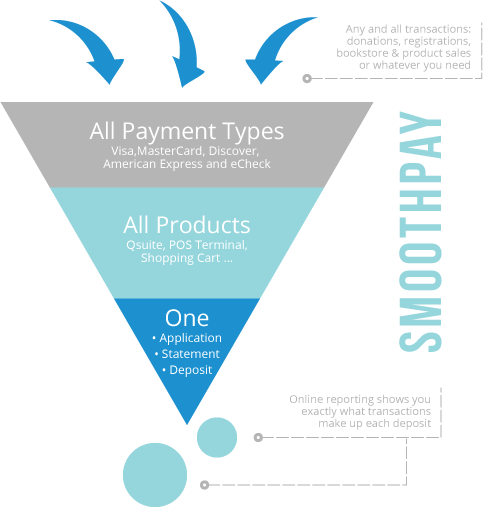

SmoothPay will transform your reconciliation process saving you time, money, and stress. SmoothPay provides you with exactly what transactions make-up each deposit sent to your bank. Additionally, it identifies the source of your transactions so you can clearly see where it originated (i.e., front office terminal, authorize.net, coffee shop, mobile payment…). No more guesswork: SmoothPay shows you exactly what deposit a transaction is a part of and clearly identifies where it originated.

Consolidated and Simplified

Additionally, SmoothPay takes your processing sources and combines their activity into a single daily deposit for all payment methods. Say goodbye to multiple daily deposits for various payment methods. Your Visa, MasterCard, Discover, American Express, and eChecks will be in a single deposit.

SmoothPay also simplifies billing and pricing into a single consolidated statement that is clear and understandable. No confusing industry codes and miscellaneous fees. SmoothPay even goes so far as to eliminate annual fees and batch fees completely.

If that wasn’t enough awesome for you, if you have multiple merchant accounts you can choose to have those accounts deposit separately or be grouped into a single deposit. Remember, SmoothPay Reporting breaks it all down!

Sweet Dreams

We built SmoothPay to remove the pain and confusion that is all too common with reconciliation. Contact us and share your reconciliation nightmare let us show you how SmoothPay can take that pain away.