This blog series of The Basics explores the industry, the players and the process to educate and answer questions on electronic payments to equip you with a better understanding of what happens behind the scenes in the world of online giving.

In this second installment of “How Payment Cards Work”, we will answer the question:

How do payment cards work and where do the different parties fit in the process?

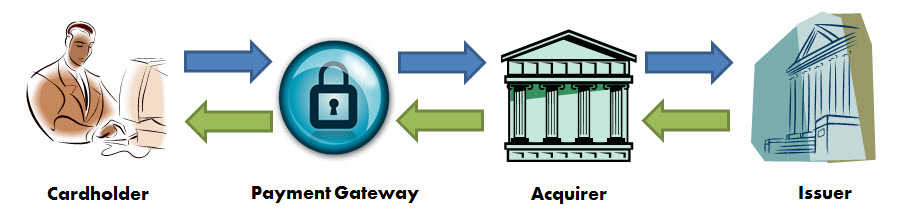

To illustrate the payment card process, it’s easiest to walk through an online donation using a debit/credit card, and provide additional details as we go. We’ll review where the different parties we learned about in Part 1 interact within the transaction process.

It all starts with a donor who wants to give online. They log on to the online giving page, click the “Give Now” button and are directed to a secure payment page. There are various versions of carts, donation and registration software, etc. that are available, but eventually the donor arrives at the payment form that collects the card information. When the donor finishes entering their information and submits the gift, the authorization process begins.

The Authorization

- The card information, as well as some of the billing address information, is submitted through a payment gateway to the processor who accepts the information for the acquirer.

- The acquirer sends the authorization request to the issuing bank (or directly to the card association) for approval.

- The issuing bank sends the authorization response to the acquirer which will be either an approval message or a decline message, in addition to AVS (Address Verification System) and CVV (Card Verification Value) response codes. If approved, the donor’s available balance may be reduced by the transaction amount in anticipation of settlement.

- The acquirer passes this information back to the gateway which interprets the response and stores the transaction record for later processing or settlement by the merchant, before passing the response back to the payment software.

- The software then displays the result to the donor on-screen and usually also sends an email receipt if an address is provided on approval. A decline will usually ask the donor for alternate payment information or instructions to try again

Usually, at the end of the day, the payment gateway or the processor will settle out the day’s activity, batching out all the approved transactions. This is known as the settlement process.

The Settlement

- The payment gateway groups the approved sale and credit transactions in a batch and sends this to the processor, or the processor automatically settles transactions depending on the setup.

- The processor submits the settlement request for the transaction(s) to the issuing bank (or card association) on behalf of the nonprofit/ministry (known as “the merchant”).

- The issuing bank then sends a response back to the processor (typically accepting the request, but rarely settlement requests can be declined). If accepted, the funds are deducted from the donor’s actual account balance.

- The processor passes the response and details to the acquirer and funds are settled between the issuing bank and the acquirer.

- Following settlement, the merchant services provider credits the merchant’s bank account for the batch total in a deposit.

For more information on the history of the payment card industry and the process, click here.