If you’ve been following the series on The Basics, then you know about the players, the process and different card types that are out there, but what about the options available to accept those cards? In this installment, we will look at the options available for the “swipe” transaction.

To Swipe or not to swipe? A very important question.

Why would you consider a swipe option versus a “virtual terminal”? The benefits of the swipe lie in the processing fees. If you are in an environment where the card is present most of the time, then you should setup a Retail merchant account which is more cost-effective than using a swipe option. These accounts offer less expensive rates than an Online/MOTO (mail order telephone order) account, because there is less risk on a swipe then a keyed transaction. This is because it is harder to forge a physical card that is magnetically read. On the other hand, if you are going to be taking payments online or over the phone more often, then it is cheaper to setup the Online/MOTO account, as these rates are almost always cheaper then the downgrades for keying in transactions on a Retail account.

Billions of cards go through terminals everyday, but how do these transactions fly with no airplane in sight?

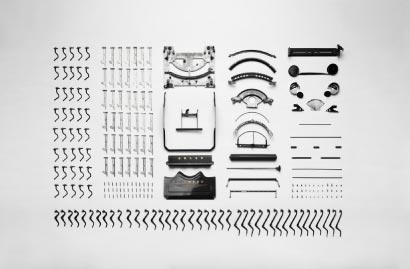

Card terminals connect to the processors either directly or through a payment gateway like an online donation would. Now some may say, “If you’ve seen one card swipe terminal, then you’ve seen them all.” However, there are key differences in how those terminals process transactions and how the information is stored and processed. Understanding what connections you have available, how much additional data you need to store with the transaction and the general price range can help you navigate the options that are out there and determine the best fit for your processing needs.

Registers and Point-of-Sale equipment with integrated swipe terminals are probably the most common swipe option we are used to seeing as consumers. Merchandise is rung up and then the cashier points to the card reader and tells you to swipe your card, or takes your card and swipes it on an integrated reader in their keyboard. These solutions may connect directly to the processor, or could use a payment gateway to pass the transaction information for authorization and settlement. These are some of the most expensive swipe options, as they require robust hardware and also have sophisticated data storage for transaction and inventory tracking. If you have a brick and mortar location where sales are going to be processed on a daily basis, with inventory control and sales tracking, then this option could be for you.

Counter-top Terminals used to be the norm and are still pretty common but they process swipe transactions independent of other software systems. The card information is stored securely in the terminal until settled in a batch (typically at the end of the day). Counter-top terminals are very versatile and process through various connections. They are a great option for church coffee stands, school offices, conventions and events where established connections are available and transactions are processed on a regular basis, but integrated inventory tracking isn’t needed. They print a paper receipt to collect the cardholder’s signature.

- Analog Terminals process transactions using a dial connection through an analog phone line, similar to how fax machines send data from one location to another. Analog terminals connect directly with the processor for transaction authorizations and settlement. Analog terminals are the cheapest option for counter-top terminals and along with Ethernet terminals, usually just have the processing cost to worry about since no additional gateway services are needed to process transactions.

- Ethernet Terminals process transactions over the internet through an Ethernet line connection. Like their analog counterpart, Ethernet terminals connect directly with the processor. These terminals can usually process via analog as a backup, making them quite versatile.

- Wireless Terminals process transactions using satellite connections, typically by way of a third party gateway that passes the transaction information onto the processor. These are the most expensive terminal options, both with the hardware cost and the monthly service fees that usually accompany the wireless satellite service used, in addition to standard processing fees.

Mobile Swipe Devices are hardware pieces that connect directly to smart phones or tablets (also known as “dongles”), or through wireless connections like BlueTooth, effectively turning the smart device into a card reader. These can process wireless transactions through downloaded apps, that use payment gateways on the back end to send the data to the processor. Typically, printed receipts are not available on mobile apps (though integrated printer options and wireless printers can be purchased), the apps will almost always have the ability to email a receipt to the cardholder. Some can collect a signature on the screen using a finger or stylus. A faster setup and cheaper option to start up than the counter-top terminal, these are great for occasional events, where physical line connections aren’t available. While the hardware is inexpensive and corresponding apps to run them might be free, the service may have monthly gateway fees and the processing fees themselves are usually more expensive than more traditional swipe retail accounts. The risk with mobile devices is they are easier to be compromised than other options, so these should only be used in a manned environment and shouldn’t be left unattended. It is easier to steal a smartphone than a bulkier counter-top terminal, so it is important to use apps that don’t store card information on the device itself, and always lock your device when not in use to hinder unauthorized access.

USB Card Readers can be used with various computer or online payment software to securely collect card information. The software will generally be written to support specific readers for this purpose, and it could range from a point-of-sale program that uses a payment gateway to pass the transaction to the processor, or direct access to a payment gateway itself. This is a great option if you have a computer available that has web access. The reporting, data tracking and receipting would depend on the software or gateway used, which usually also affects the overall cost.

Stop! You can’t swipe this.

So what happens if your reader doesn’t read the card? The options mentioned above will almost always have an option to key in the card information. It is important to remember that keyed transactions will downgrade on a Retail account, so it is more expensive to process transactions that are keyed in instead of swiped, but these transactions should be the exception, not the norm. However, when it is necessary, get an imprint of the card on a sales draft (if at all possible) and have the card holder sign it. The draft should include the date, a description of the goods or services, the total amount and the sales associate’s initials. This helps protect you from potential charge backs when the swipe data is not collected. We will take a closer look at the non-swipe options for the keyed and/or card-not-present transactions in the next installment.

For additional information on fraud prevention in a card-present environment, click here.

Photo Credit: LotusHead, www.pixelpusher.co.za

Founded in 1999, The CashLINQ Group is a leader in providing comprehensive payment processing solutions to a wide range of nonprofit organizations including Christian ministries, churches, colleges and radio stations throughout the United States and Canada. CashLINQ provides the latest processing technology using a fully certified Level 1 PCI-DSS platform and PA-DSS compliant solutions. As an end-to-end solution provider, The CashLINQ Group handles all risk and underwriting functions, initiating our own merchant and electronic check accounts while providing excellent service and support through a dedicated Customer Engagement Team.